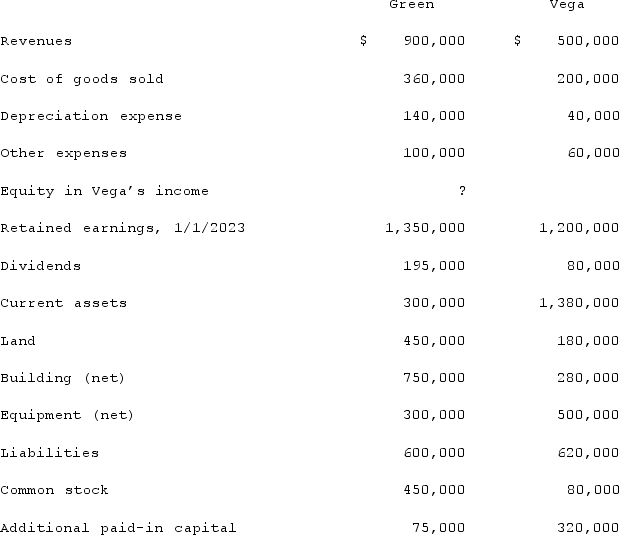

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Definitions:

Pricing Strategy

A method or model used by businesses to set the selling price for their products or services, taking into account factors like cost, competition, target market, and overall business objectives.

Upscale Running Gear

refers to high-quality, often expensive, running attire and equipment designed for serious or professional athletes seeking performance improvement.

Prestige Product

High-quality goods that are sold at a high price, often seen as status symbols, and used to convey a sense of exclusivity or luxury.

Hermès

A French luxury goods manufacturer known for its high-quality leather goods, lifestyle accessories, perfumery, and ready-to-wear.

Q4: Return on investment (ROI)for a firm is<br>A)

Q4: All of the following statements regarding the

Q15: With regard to social media,which statement is

Q17: Flynn acquires 100 percent of the outstanding

Q19: Which media metric is indicated by the

Q43: Stark Company, a 90% owned subsidiary of

Q47: After allocating cost in excess of book

Q55: Fesler Inc. acquired all of the outstanding

Q79: Strickland Company sells inventory to its parent,

Q121: Several years ago, Polar Inc. acquired an