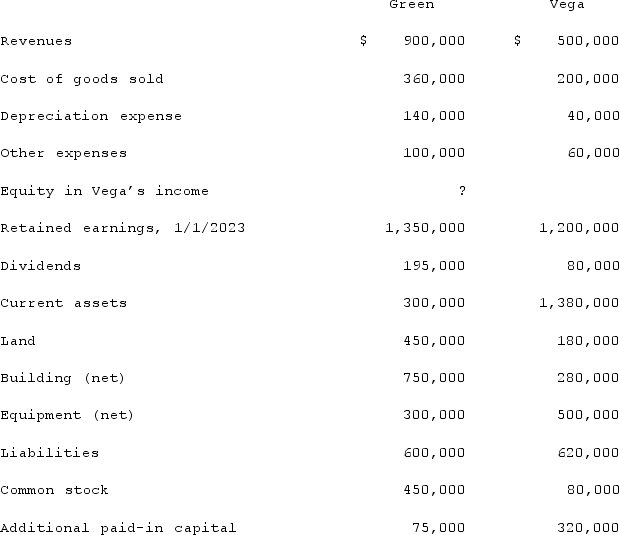

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Definitions:

Nominal Interest Rate

The interest rate expressed in dollars of current value (that is, not adjusted for inflation) as a percentage of the amount loaned; the interest rate specified on the loan agreement.

Expected Inflation

The rate at which the general level of prices for goods and services is rising, as anticipated by consumers and businesses.

Real Interest Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield to investors.

Anticipated Inflation Rate

The inflation rate that individuals and businesses expect to prevail in the future, influencing their economic decisions.

Q6: Flynn acquires 100 percent of the outstanding

Q9: On January 1, 2018, Vacker Co. acquired

Q25: Allen Co. held 80% of the common

Q43: Wolff corporation owns 70% of the outstanding

Q77: Which of the following conditions will allow

Q91: On January 1, 2021, Doyle Corp. acquired

Q93: Paris, Inc. owns 80% of the voting

Q99: On January 1, 2020, Mehan, Incorporated purchased

Q117: Patti Company owns 80% of the common

Q123: Jackson Company acquires 100% of the stock