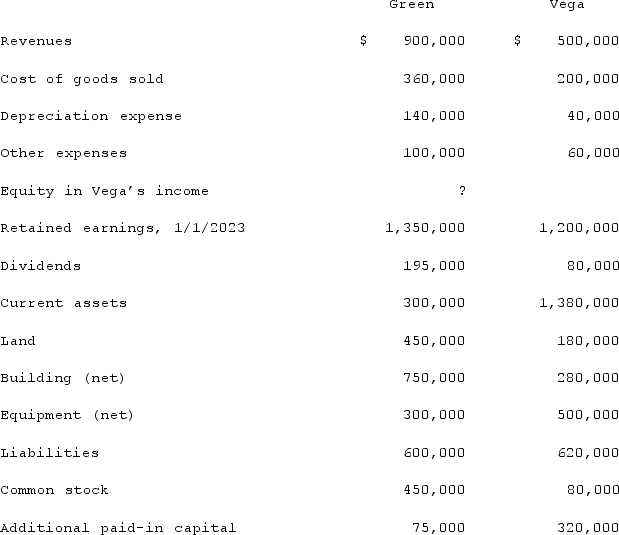

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated trademark.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated trademark.

Definitions:

Kirkpatrick's Model

A method for assessing the effectiveness of training programs through four distinct levels: Reaction, Learning, Behavior, and Results, emphasizing the importance of evaluating multiple aspects of training.

Return On Investment

A financial metric used to evaluate the efficiency or profitability of an investment, calculated by dividing the benefit (return) by the cost of the investment.

Training Evaluation

The process of assessing the effectiveness of a training program, often using criteria such as learner satisfaction, learning achieved, and behavior change.

Break-Even

The point at which total costs and total revenue are equal, leading to no net loss or gain for a business.

Q11: Beatty, Inc. acquires 100% of the voting

Q29: On January 1, 2020, Smeder Company, an

Q46: Daniels Inc. acquired 85% of the outstanding

Q49: Stiller Company, an 80% owned subsidiary of

Q76: Under the initial value method, when accounting

Q81: Pell Company acquires 80% of Demers Company

Q84: When the fair value option is elected

Q90: Presented below are the financial balances for

Q103: Flintstone Inc. acquired all of Rubble Co.

Q119: On January 1, 2020, Smeder Company, an