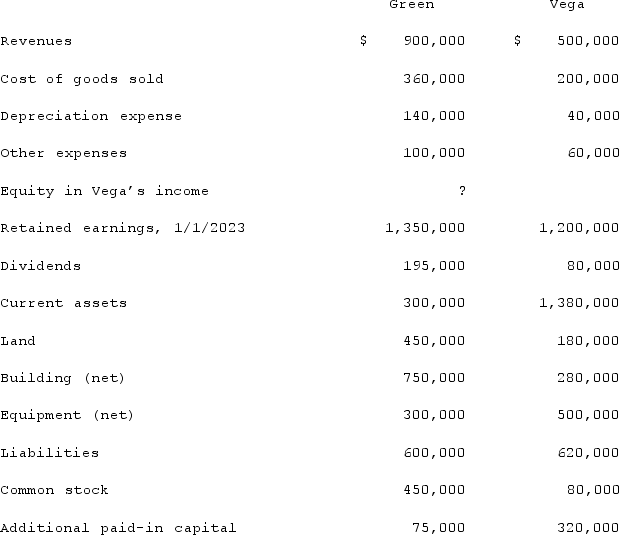

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated additional paid-in capital.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated additional paid-in capital.

Definitions:

Collateral Damage

Unintended or incidental damage or casualties not directly intended by the action.

Economic Swings

Periods of economic fluctuation that a country experiences, encompassing both expansions (growth) and contractions (recessions) in its economy.

Political Issues

Matters related to government, policies, and political processes that affect how a society is governed.

Economic Issues

Challenges related to the production, distribution, and consumption of goods and services within an economy.

Q14: Fesler Inc. acquired all of the outstanding

Q15: Panton, Inc. acquired 18,000 shares of Glotfelty

Q27: Utah Inc. acquired all of the outstanding

Q37: Pell Company acquires 80% of Demers Company

Q54: The financial statements for Jode Inc. and

Q59: Unlike break-even pricing,markup pricing uses complicated concepts

Q88: According to the FASB ASC regarding the

Q91: Which of the following methods is not

Q118: Anderson Company, a 90% owned subsidiary of

Q120: A reasonable level of profits consistent with