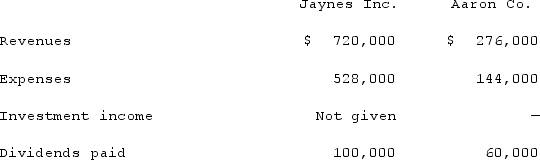

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

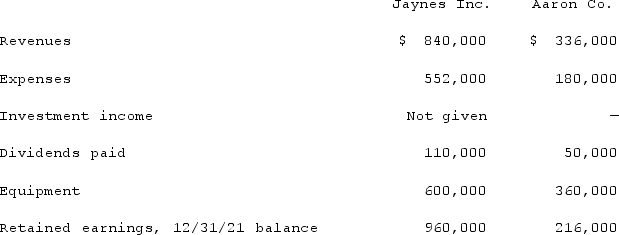

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

Definitions:

Genetic Disorders

Diseases or conditions caused by an abnormality in an individual's DNA, which can be inherited or occur due to mutations.

Carriers

Individuals who possess one copy of a gene mutation that can lead to a genetic disorder if passed on to offspring, but do not typically show symptoms of the disorder themselves.

Birth Process

Is the series of events that lead to the delivery of a baby, beginning with labor and culminating in childbirth.

Classified

A term used to describe something that has been arranged in categories or classified based on specific criteria.

Q2: A software program that searches the Web

Q44: Cayman Inc. bought 30% of Maya Company

Q58: Steven Company owns 40% of the outstanding

Q66: On January 1, 2020, Mace Co. acquired

Q74: Milton Co. owned all of the voting

Q75: McGraw Corp. owned all of the voting

Q97: Strickland Company sells inventory to its parent,

Q107: All of the following are examples of

Q109: Which of the following statements is true

Q123: Kenzie Co. acquired 70% of McCready Co.