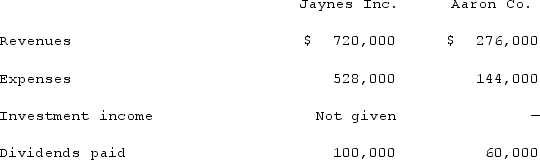

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

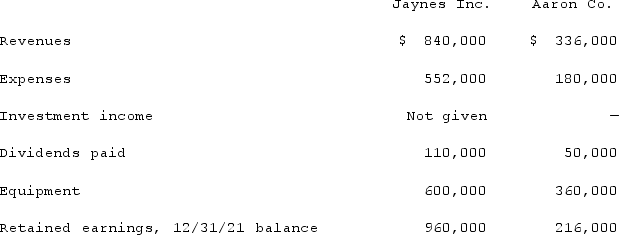

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was the total for consolidated patents as of December 31, 2021?

What was the total for consolidated patents as of December 31, 2021?

Definitions:

Communication Style

The characteristic way in which an individual conveys information verbally and non-verbally.

Translator

A person who converts written text from one language into another, maintaining the meaning, style, and context of the original message.

Middle Path

A concept often used in therapeutic settings, representing a balanced approach to problem-solving and decision-making, avoiding extremes.

Professional Help

Assistance provided by individuals or organizations who have expert knowledge or qualifications in a specific field.

Q7: Watkins, Inc. acquires all of the outstanding

Q14: Fesler Inc. acquired all of the outstanding

Q17: Idler Co. has an investment in Cowl

Q27: Consumers are more likely to perceive the

Q54: On January 2, 2021, Barley Corp. purchased

Q55: What method is used in consolidation to

Q86: Discuss how the mobile platform is emerging

Q101: Milton Co. owned all of the voting

Q120: McLaughlin, Inc. acquires 70% of Ellis Corporation

Q122: Walsh Company sells inventory to its subsidiary,