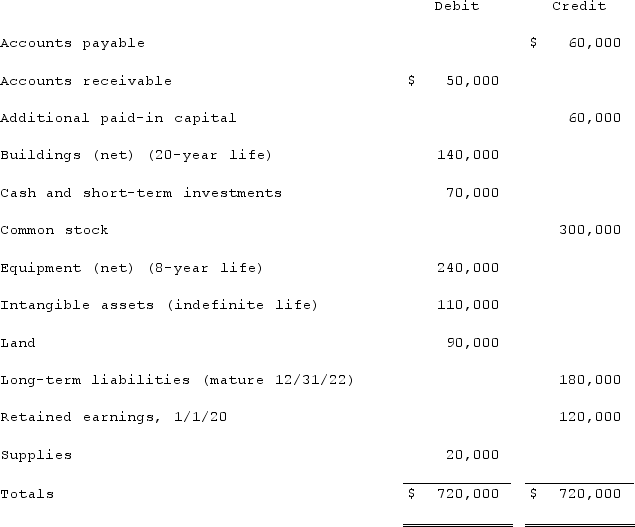

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Jackson had the following trial balance:  During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

Definitions:

Principle Reasons

The fundamental or primary causes and motivations behind an action or situation.

Delaying

The act of postponing or deferring an action or event to a later time.

Born Out of Wedlock

Refers to a child born to parents who are not legally married to each other.

Foster Children

Children placed by a government or a social service agency into temporary care with a state-certified caregiver, known as foster parents.

Q25: The financial statements for Campbell, Inc., and

Q29: Ryan Company purchased 80% of Chase Company

Q46: When using _,the seller pays all or

Q48: The financial statement amounts for the Atwood

Q77: Wilson owned equipment with an estimated life

Q80: Pell Company acquires 80% of Demers Company

Q88: Adequate distribution for a new product can

Q96: Waite, Inc. owns 85% of Knight Corp.

Q108: On January 1, 2021, Pride, Inc. acquired

Q117: Which of the following statements is true