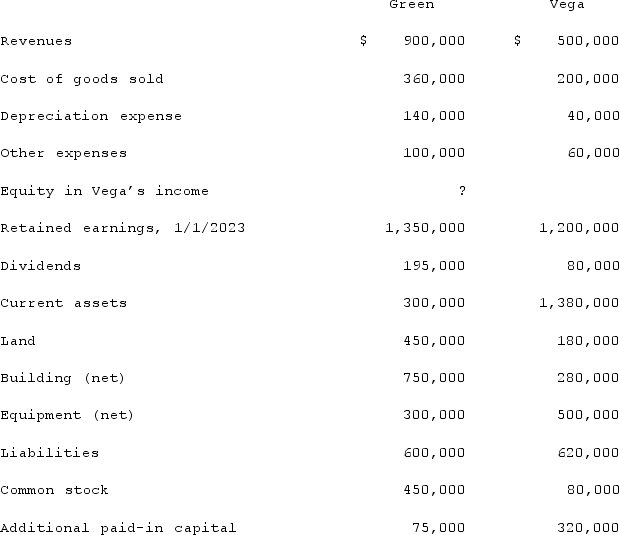

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Definitions:

Selling Price

The cost at which consumers can purchase a product or service.

Contribution Margin

The amount remaining from sales revenue after all variable expenses have been deducted, indicating how much revenue is contributing to covering fixed expenses and generating profit.

Unit Sold

The total number of individual items or products that have been sold by a business during a given period.

Variable Cost

Costs that change in direct proportion to changes in the levels of production or sales activities, such as materials and labor costs.

Q11: On January 1, 2020, Mace Co. acquired

Q12: LaFevor Co. acquired 70% of the common

Q16: A price reduction offered to buyers who

Q39: Which of the following statements is true

Q42: Jackson Company acquires 100% of the stock

Q84: When the fair value option is elected

Q95: On January 1, 2019, Palk Corp. and

Q95: On January 1, 2021, Jackie Corp. purchased

Q96: Define price and discuss the role of

Q96: Dodd Co. acquired 75% of the common