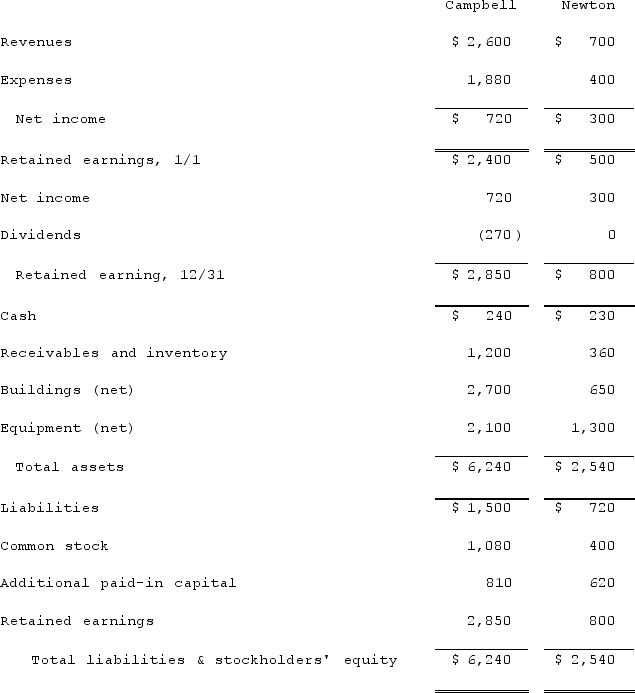

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated receivables and inventory for 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated receivables and inventory for 2021.

Definitions:

Memory Report

The process or act of recalling and articulating what has been previously encoded and stored in the brain, often used in research or clinical contexts to assess memory function.

Procedural Memories

Memories of how to perform certain skills and actions, such as riding a bike or tying shoelaces, which are often recalled unconsciously.

New Skills

Abilities or proficiencies acquired through practice, training, or learning that were not previously possessed by an individual.

New Words

Lexical items that have been recently created or entered into a language.

Q18: Avery Company acquires Billings Company in a

Q42: Dodd Co. acquired 75% of the common

Q43: When Valley Co. acquired 80% of the

Q45: On January 1, 2021, Musical Corp. sold

Q52: Following are selected accounts for Green Corporation

Q56: Which of the following refers to a

Q66: Anderson Company, a 90% owned subsidiary of

Q80: Davis Company has had bonds payable of

Q96: Define price and discuss the role of

Q125: McGuire Company acquired 90 percent of Hogan