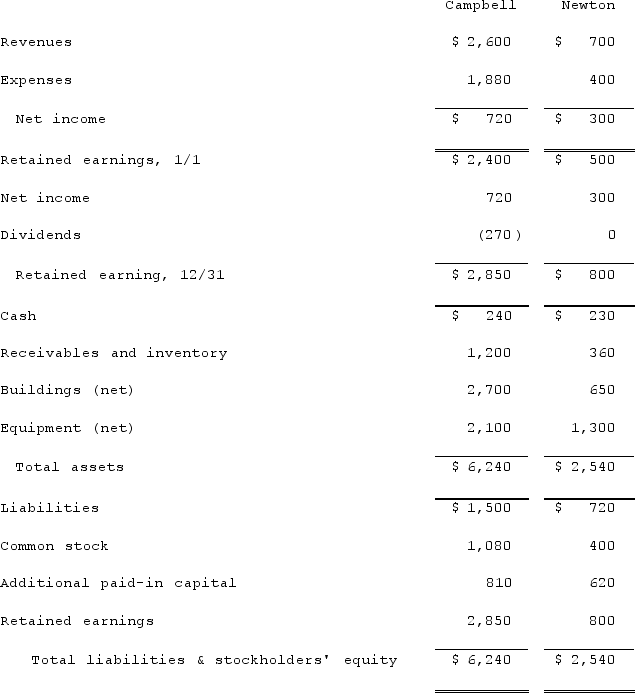

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated common stock account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated common stock account at December 31, 2021.

Definitions:

Political Action Committees

Organizations that collect funds to donate to political campaigns or to spend on behalf of political initiatives.

IRS

The Internal Revenue Service, a U.S. federal agency responsible for tax collection and tax law enforcement.

Lobby

The act of attempting to influence decisions made by officials in the government, often by special interest groups or professional lobbyists.

Social Change

The transformation over time of cultural values, norms, and societal structures which can result in significant shifts in societal behavior and policy.

Q25: Media sharing sites allow users to decide

Q44: Cayman Inc. bought 30% of Maya Company

Q66: When an investor appropriately applies the equity

Q68: Short message service (SMS)is different from multimedia

Q70: Pell Company acquires 80% of Demers Company

Q98: Prater Inc. owned 85% of the voting

Q103: Pell Company acquires 80% of Demers Company

Q104: Presented below are the financial balances for

Q110: Colbert Inc. acquired 100% of Stewart Manufacturing

Q114: How are direct and indirect costs accounted