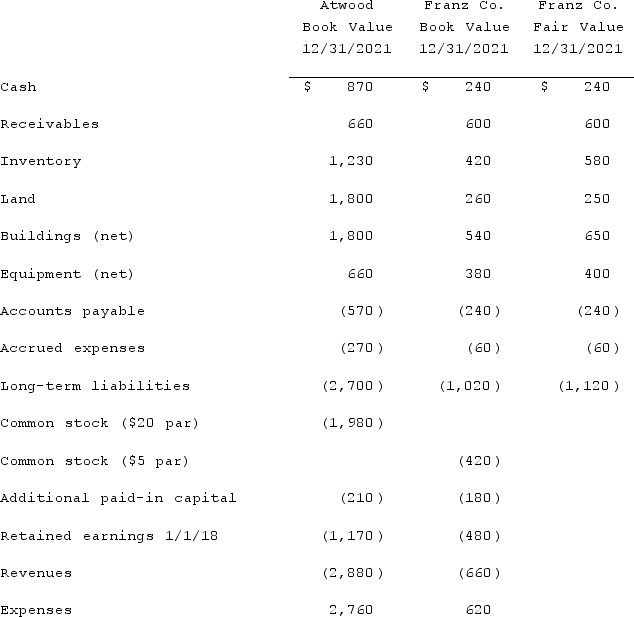

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

Definitions:

Diversified Portfolio

An investment portfolio constructed with a mix of assets to reduce exposure to risk associated with any single asset or asset class.

Market Risk

The risk of losses in investments due to factors that affect the entire market, such as economic shifts or political events.

Asset-Specific Risk

The risk associated with holding a particular asset, which can be reduced through diversification.

Security Market Line

A representation of the capital asset pricing model (CAPM), showing the relationship between the expected return of a security and its risk as measured by beta.

Q7: Watkins, Inc. acquires all of the outstanding

Q8: Virginia Corp. owned all of the voting

Q41: Anderson Company, a 90% owned subsidiary of

Q42: Vickers Inc. acquired all of the common

Q44: Pell Company acquires 80% of Demers Company

Q51: A parent company owns a controlling interest

Q51: A sales manager's sole function is to

Q52: Flax Co. acquired 80% percent of the

Q100: A parent company owns a 70% interest

Q112: On January 4, 2020, Nelson Corporation purchased