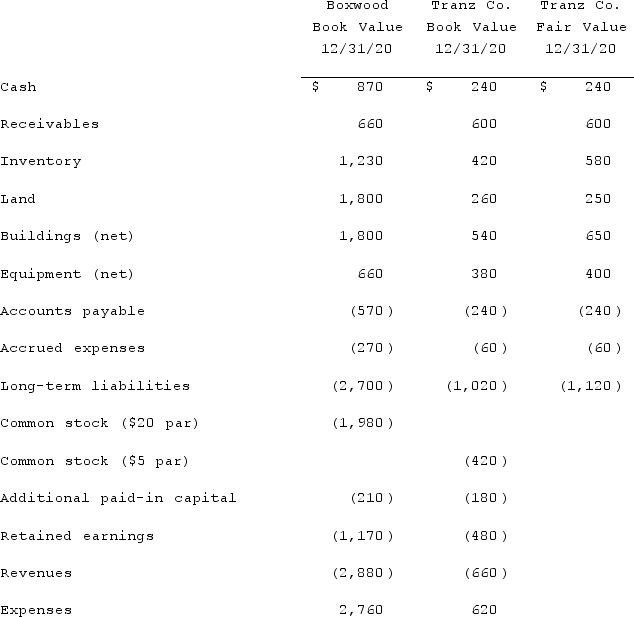

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated revenues immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated revenues immediately following the acquisition.

Definitions:

Social Institutions

Established systems or structures within a society that govern the behavior and expectations of individuals, such as family, education, and government.

Raised In Isolation

The condition of being brought up in an environment that is significantly devoid of normal social interaction and exposure to the outside world.

Develop Normally

The process of growing or evolving according to expected patterns or stages of physical, mental, or emotional growth.

Total Institutions

are places of residence and work where large numbers of individuals are cut off from wider society for a considerable period, leading lives enclosed and regulated by the institution.

Q1: Wilkins Inc. acquired 100% of the voting

Q61: You are auditing a company that owns

Q75: Parsons Company acquired 90% of Roxy Company

Q93: Flynn acquires 100 percent of the outstanding

Q98: Which form of advertising promotes the benefits

Q105: On January 1, 2020, Barber Corp. paid

Q107: How should direct combination costs and amounts

Q108: On January 1, 2021, Pride, Inc. acquired

Q109: _ is a form of institutional advertising.<br>A)

Q125: Pepe, Incorporated acquired 60% of Devin Company