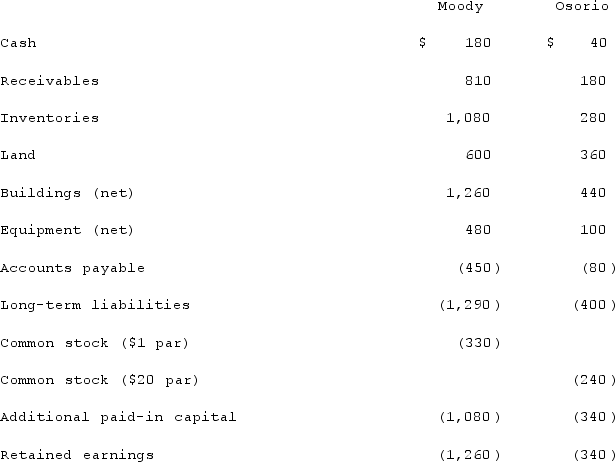

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Definitions:

Statement Of Financial Position

Another term for the balance sheet, a financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time.

Common-Size Statement

A financial analysis tool that displays line items as a percentage of one selected or common figure, facilitating comparisons across different financial periods or companies.

Total Sales

The entirety of a company's revenues generated from the sale of goods or services before any expenses are subtracted.

Du Pont Identity

A financial analysis framework that breaks down return on equity into three components: profit margin, asset turnover, and financial leverage, highlighting how these factors affect a company's overall financial performance.

Q11: Which statement best defines price fixing?<br>A) A

Q27: Consumers are more likely to perceive the

Q27: Utah Inc. acquired all of the outstanding

Q35: What is the purpose of Consolidation Entry

Q53: On January 3, 2021, Heinreich Co. paid

Q64: For an acquisition when the subsidiary maintains

Q70: While much of the excitement in social

Q96: On January 1, 2021, Pride, Inc. acquired

Q98: Which of the following results in an

Q108: On January 1, 2020, Archer, Incorporated, paid