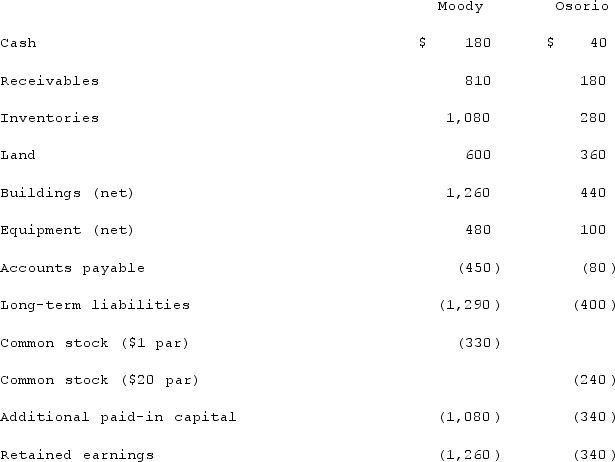

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Definitions:

Organ

A part of the body constructed of many types of tissue to perform a function.

Therapeutic Radiation

Used in the treatment of cancer by preventing cellular reproduction.

Treatment

The management and care of a patient or the combating of disease or disorder.

Cancer

A broad group of diseases involving abnormal cell growth with the potential to invade or spread to other parts of the body.

Q3: Marketers have found that social news sites

Q12: In personal selling,cost per contact is much

Q42: On January 3, 2020, Baxter, Inc. acquired

Q46: Apps are software applications that run entirely

Q51: Wilkins Inc. acquired 100% of the voting

Q67: Anderson Company, a 90% owned subsidiary of

Q85: Briefly explain how distribution strategy acts as

Q92: The financial statement amounts for the Atwood

Q104: Wilson owned equipment with an estimated life

Q122: Which of the following refers to a