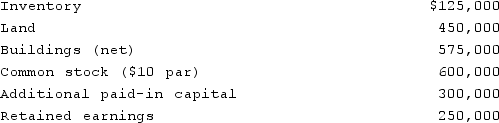

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.On December 31, 2020, assuming that McCoy will retain its separate corporate existence, what value is assigned to Ferguson's investment account?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.On December 31, 2020, assuming that McCoy will retain its separate corporate existence, what value is assigned to Ferguson's investment account?

Definitions:

Sprain

An injury to ligaments caused by being stretched beyond their normal capacity and possibly torn.

Osteoporosis

A condition characterized by weakened bones that are more prone to fracture due to a decrease in bone density and quality.

Rheumatoid Arthritis

A chronic autoimmune disorder that primarily affects joints, leading to inflammation, pain, and eventually joint damage and deformity.

Bone Remodeling

The continuous turnover process of bone tissue that involves bone formation and resorption.

Q14: Panton, Inc. acquired 18,000 shares of Glotfelty

Q33: On January 1, 2021, Musical Corp. sold

Q35: Pell Company acquires 80% of Demers Company

Q75: The balance sheets of Butler, Inc. and

Q89: Which of the following statements is true

Q92: What is the primary objective of the

Q97: On January 1, 2021, Harrison Corporation spent

Q97: Wilkins Inc. acquired 100% of the voting

Q101: At a local supermarket,Linda saw a box

Q114: On January 4, 2020, Nelson Corporation purchased