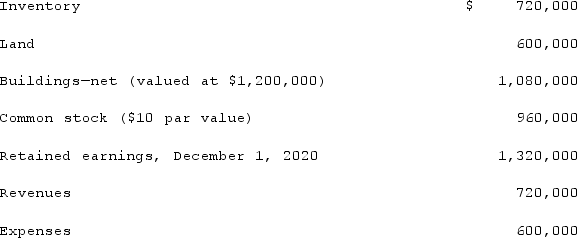

Salem Co. had the following account balances as of December 1, 2020:  Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Definitions:

Short Words

Brief and concise words, often used to enhance clarity and comprehension in communication.

Brooklyn Dodgers

A historic Major League Baseball team known for breaking the color barrier when they signed Jackie Robinson in 1947.

Playing Field

An area marked and prepared for sports or games, or metaphorically, a space or sphere where activities and competition occur.

Inspectors General

Officials responsible for overseeing and auditing the administrative actions and financial operations of government agencies to ensure legality and efficiency.

Q30: A cash refund given for the purchase

Q32: Bassett Inc. acquired all of the outstanding

Q69: Wilson owned equipment with an estimated life

Q77: What is pre-acquisition income?

Q79: For each of the following situations, select

Q84: When the fair value option is elected

Q87: Patti Company owns 80% of the common

Q88: On January 2, 2020, Pond Co. acquired

Q89: When Valley Co. acquired 80% of the

Q110: Which of the following statements is true