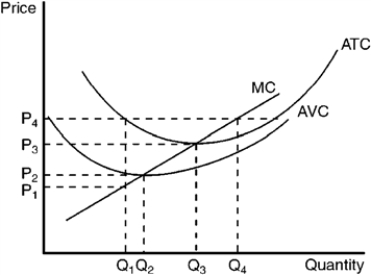

The graph below depicts the cost structure for a firm in a competitive market.

Figure 9-13

-Refer to Figure 9-13. When price rises from P2 to P3, the firm finds that

Definitions:

Book Income

The net income reported by a company as per its financial statements, reflecting its accounting principles rather than taxable income.

Interperiod Tax Allocation

The process of distributing tax expenses or benefits over different accounting periods due to temporary differences between financial accounting and tax accounting rules.

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing the total tax paid by taxable income.

Income Tax Expense

The amount of money a company or individual owes in taxes based on their taxable income for a given period.

Q6: If we say that an object is

Q37: Which of the following explains most clearly

Q58: _ is a measure of the light

Q88: Over the last five decades, the proportion

Q110: Which of the following factors are likely

Q113: "A good business decision maker will never

Q115: The average variable cost (AVC) and average

Q121: As the share of healthcare expenditures paid

Q142: Which of the following would help control

Q174: Women earn less on average than men.