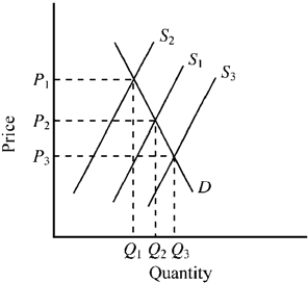

Figure 5-1

-In Figure 5-1, S1 and D illustrate the demand and supply for a product if it were produced in a normal competitive market. Which of the following would be true if the firms in the industry were instead able to get government licensing restrictions to limit competition in the market?

Definitions:

Cash Flows

The net amount of cash being transferred into and out of a business, considered essential for assessing its financial health.

Cost of Capital

The cost of capital is the rate of return that a company must earn on its investment projects to maintain its market value and attract funds.

Crossover Rate

The discount rate at which two projects have the same net present value (NPV), used in capital budgeting.

IRR

Internal Rate of Return, a financial metric used to assess the profitability of potential investments, measuring the discount rate at which the net present value of costs and benefits equal zero.

Q15: John Smith is a typical citizen. Economic

Q31: A good that is both nonexcludable and

Q33: Suppose the demand curve for a good

Q45: Refer to Figure 4-17. Which of the

Q55: Producers are willing to offer greater quantities

Q66: A law establishing a maximum legal price

Q109: In 2015, government income transfers redistributed what

Q118: Which of the following provides the most

Q233: Figure 4-3 indicates the demand (D) and

Q289: Which of the following investments is characterized