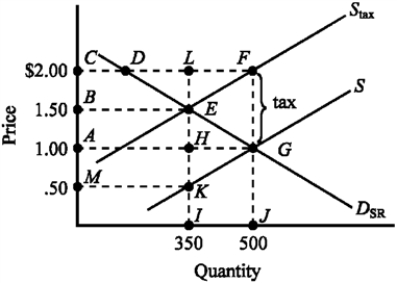

Use the figure below illustrating the impact of an excise tax to answer the following question(s) .

Figure 4-6

-Refer to Figure 4-6. The amount of the actual tax burden paid by consumers and producers is

Definitions:

Price Elasticity

The responsiveness of the quantity of a product demanded to a variation in its price, determined by dividing the percentage variation in the quantity demanded by the percentage modification in the product’s price.

Separate Markets

Economic markets that are distinctly separated by geographical boundaries, preferences, or other factors, preventing the mixing of products or services.

Resold

The action of selling an item or asset that has previously been sold or owned by someone else.

Monopolist's Profits

The earnings a monopolist achieves, which are typically higher than in competitive markets due to the ability to set prices above marginal costs.

Q14: Which of the following generalizations about the

Q15: Assume that supply increases slightly and demand

Q31: Which of the following is an example

Q36: A perfectly inelastic demand curve indicates that<br>A)

Q60: When there is excess supply of a

Q63: The government sometimes provides public goods because<br>A)

Q110: Which of the following is accurate regarding

Q161: When competitive forces in an industry are

Q242: Which of the following about minimum wage

Q339: If you were a government official that