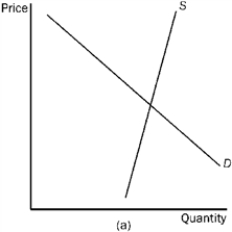

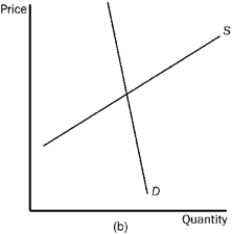

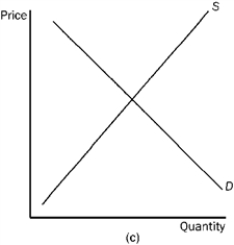

Figure 4-23

-Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

Definitions:

Non-Controlling Interest (NCI)

A financial interest in a subsidiary attributed to shareholders outside of the controlling shareholder group, reflecting their share of the entity's equity that isn’t controlled by the parent company.

Identifiable Net Assets (INA) Method

is a technique used in business combinations to value the acquired company by summing the fair values of its identifiable assets and liabilities.

Proportionate Consolidation Method

An accounting technique used for joint ventures, where an entity's share of each of the assets, liabilities, income, and expenses are combined line by line with similar items in the entity's financial statements.

Non-Controlling Interest (NCI)

It represents the equity in a subsidiary not attributable, directly or indirectly, to the parent company.

Q2: If there is an increase in both

Q39: Because of the free-rider problem,<br>A) competitive markets

Q46: In Figure 4-15, suppose a price floor

Q87: Refer to Figure 4-7. The supply curve

Q90: Data from the effects of the substantial

Q140: What prompted the large increase in tax

Q193: An income tax is progressive if the<br>A)

Q205: Graphically, what impact would an increase in

Q206: If Mr. Smith thinks the last dollar

Q399: A decrease in supply will cause<br>A) an