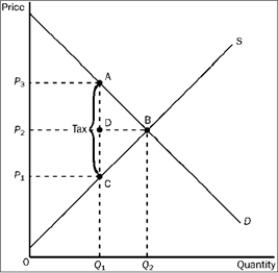

Figure 4-24

-Refer to Figure 4-24. The per-unit burden of the tax on sellers is

Definitions:

Stock Split

A corporate action that increases the number of a company's outstanding shares by dividing each share, which can make the stock more affordable to investors.

Market Value

The estimated amount for which an asset or company could be sold on the open market.

Optimal Distribution Policy

The distribution policy that maximizes the value of the firm by choosing the optimal level and form of distributions (dividends and stock repurchases).

Capital Gains

Capital gains are the profits realized from the sale of assets such as stocks, bonds, or real estate, which exceed the purchase price of these assets.

Q31: Refer to Figure 4-25. After the tax

Q72: Which of the following statements is false?<br>A)

Q78: When economists say that market equilibrium is

Q133: If new regulations make it illegal to

Q147: If the supply of a good increased,

Q178: People who receive the benefit of a

Q189: Special-interest legislation is characterized by<br>A) concentrated costs

Q201: When overall production is taken into account,

Q225: Refer to Figure 4-20. The amount of

Q352: Graphically, the area that represents the difference