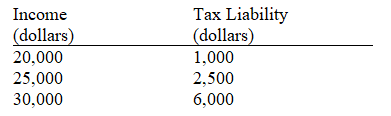

Use the table below to choose the correct answer.

The marginal tax rate on income in the $25,000 to $30,000 range is

Definitions:

Standard Direct Labor Cost

The predetermined cost of labor assigned directly to the production of goods, based on estimated time and wage rates.

Total Overhead Variance

The difference between the actual overhead incurred and the overhead allocated to production over a period.

Sales Price Variance

The difference between the actual selling price and the expected selling price of a product multiplied by the number of units sold.

Average Price

The mean cost of a commodity or service computed by dividing the total cost of all units purchased by the number of units.

Q19: Which of the following has enhanced the

Q30: Public choice analysis<br>A) assumes individuals in the

Q70: If the number of consumers in a

Q120: Is your economics textbook a public or

Q137: Which of the following factors weakens the

Q137: Refer to Figure 4-19. When the price

Q142: The increase in the share of loans

Q160: Which of the following is true about

Q197: Figure 6-2 illustrates the four possibilities of

Q408: If the price of coffee decreases, the