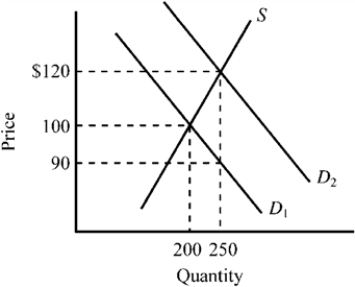

Use the figure below to answer the following question(s) .

Figure 4-12

-Refer to Figure 4-12. The supply curve S and the demand curve D1 indicate initial conditions in the market for college textbooks. A new government program is implemented that grants students a $30 per textbook subsidy on every textbook they purchase, shifting the demand curve from D1 to D2. Which of the following is true for this subsidy given the information provided in the exhibit?

Definitions:

Profitability Index

A financial tool that calculates the ratio of the present value of future expected cash flows to the initial investment cost.

Working Capital

A disparity between a firm's current holdings and its outstanding obligations, signifying its short-term economic fitness and effectiveness in functioning.

Discount Rate

In the context of discounted cash flow analysis, this is the interest rate used to establish the present-day value of future cash inflows.

Net Operating Cash Inflows

This represents the cash that a business generates from its ordinary, operational activities, excluding financing or investment cash flows.

Q7: Economic efficiency indicates that<br>A) if something is

Q92: When government failure is present,<br>A) market allocation

Q105: If a federal agency requested funds to

Q105: If a $500 tax is placed legally

Q128: Why do nations impose trade barriers, such

Q129: Which one of the following is a

Q166: Which of the following provides the best

Q333: Which of the following provides the strongest

Q357: A decrease in the price of leather

Q390: "He [the producer] intends only his gain,