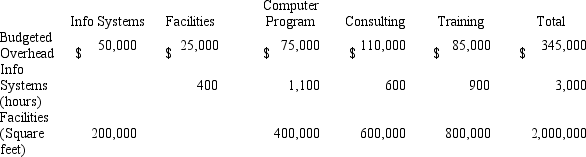

Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs: the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department.

Service Departments User Departments

Information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space.

Required:

Allocate the service department costs to the user departments using the reciprocal method. Round to the nearest whole dollar.

Definitions:

Accrued Interest

Interest that has been earned but not yet paid or received.

Accrued Interest

Accrued interest refers to the interest that has accumulated on a bond or loan since the last interest payment was made.

360-Day Year

A financial concept that simplifies the calculation of interest over periods when the actual number of days in a year is considered to be 360.

Commission

A fee or percentage of a transaction paid to an agent or employee for facilitating or completing a sale.

Q7: Trini Inc. bases its manufacturing overhead budget

Q28: The purpose of the Data Processing Department

Q32: Which of the following statements is (are)

Q49: Bonanza Co. manufactures products X and

Q59: Allentown Company has been busy over the

Q67: The Arkansas Company makes and sells a

Q86: A master budget:<br>A) indicates costs of the

Q96: The Barton Creek Company has three

Q137: Accounting for direct materials and direct labor

Q150: <br>The cost accountant determined $1,700,000 of the