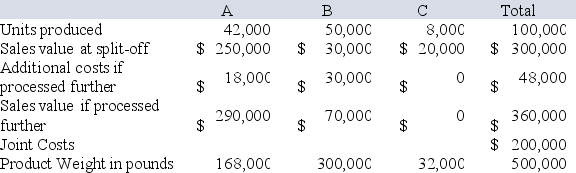

Ridgeline Enterprises produces three products in a joint process. Products A and B are processed further. Additional information is as follows:

Required:

(a) Allocate the joint costs, assuming that all products are joint products and joint-costs are allocated using the physical quantities method.

(b) Allocate the joint costs using the physical quantities method, assuming that product C is considered a by-product, whose sales value is deducted from the total joint costs.

Definitions:

Operating Income

Income generated from regular business operations, excluding non-operating income and expenses, interest, and taxes.

Initial Value Method

An accounting technique where investments are recorded at their original purchase cost, without subsequent adjustment for increases or decreases in value.

Intra-entity Transfers

Transactions of goods, services, or resources between units within the same organization, potentially requiring adjustments for financial reporting.

Separate Income Tax Returns

Tax filings completed individually by entities or divisions of a larger corporation, rather than as a consolidated group.

Q5: The journal entry to apply manufacturing overhead

Q6: <br>How many units were started and completed

Q32: Seaside Enterprises has the following data

Q68: <br>The manufacturing overhead that would be applied

Q110: <br>What is the amount of the sales

Q116: Cost pools are used with:<br> <span

Q118: Vargus Corporation has an activity-based costing

Q133: Which of the following statements about activity-based

Q134: The controllability concept states that managers should

Q139: Which of the following statements regarding quality