On October 1, the general ledger of Morgan Industries had the following accounts and balances:

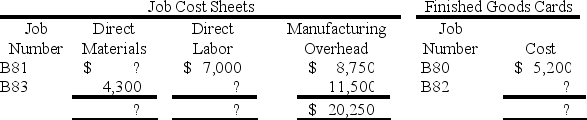

The subsidiary ledgers had the following information on October 1:

During October, the following costs were incurred on account:

A summary of the materials requisition slips and the labor time tickets for the month revealed the following distribution:

Overhead is applied based upon direct labor cost. Jobs B81, B83, and B84 were for 8,000, 6,000 and 4,800 units of product, respectively, and were completed during October. Jobs B80, B81, B82, and B83 were sold on account for $150,000.

Required:

Prepare T-accounts for a job costing system, posting the beginning balances and all transactions for the month. Clearly indicate the ending balances for the accounts and label the 'cost of goods manufactured' and 'cost of goods sold' amounts.

Definitions:

Nasogastric Tube

A flexible tube passed through the nose into the stomach, used for feeding or removing stomach contents.

Auscultate

The act of listening to the internal sounds of the body, typically using a stethoscope, as part of a medical examination.

Aspirate

To draw in or out using a suctioning action, often referring to the inhalation of food or liquid into the lungs, or the removal of substances from the body.

Gastric Contents

The material present in the stomach, including ingested food, stomach acid, enzymes, and sometimes ingested foreign objects.

Q8: <br>(Note: The General Factory costs are allocated

Q59: JennerMaid Company manufactures and distributes several

Q67: <br>What would be the total of the

Q70: Logansville Manufacturing produces lamps for large

Q85: Kid's World Manufacturing Company is a

Q97: During July, Morris Corporation purchased $76,000 of

Q98: In a job costing system, direct material

Q122: <br>In a regression equation expressed as y

Q125: Franklin Industrial Equipment Corporation manufactures lawn

Q144: If a company has identified three major