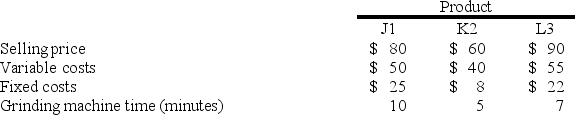

Atuso, Inc. produces three products. Data concerning the selling prices and unit costs of the three products appear below:

Fixed costs are applied to the products on the basis of direct labor hours.

Demand for the three products exceeds the company's productive capacity. The grinding machine is the constraint, with only 2,400 minutes of grinding machine time available this week.

Required:

a. Given the grinding machine constraint, which product should be emphasized? Support your answer with appropriate calculations.

b. Assuming that there is still unfilled demand for the product that the company should emphasize in part (a) above, up to how much should the company be willing to pay for an additional hour of grinding machine time?

Definitions:

Ownership Interest

A party's ownership stake in an entity, represented by the proportion of shares or equity they hold.

Dividends Paid

The portion of a company's earnings that is distributed to shareholders, typically in the form of cash or additional shares.

Voting Shares

Shares that give the shareholder the right to vote on matters of corporate policy and the election of the board of directors.

Carrying Value

The book value of an asset on a company’s balance sheet, calculated as its original cost minus accumulated depreciation or amortization.

Q10: <br>If Macon expects to use 10,000 machine

Q36: Financial accounting provides a historical perspective, while

Q38: At what sales volume would the two

Q42: Place the letter of the appropriate business

Q56: Which of the following statements about the

Q63: Describe the effect on cost estimation of

Q78: Assuming no changes are expected for the

Q87: Cost-volume-profit (CVP) analysis is more complicated for

Q120: What sales volume does Lake's need to

Q143: How does job costing for a service