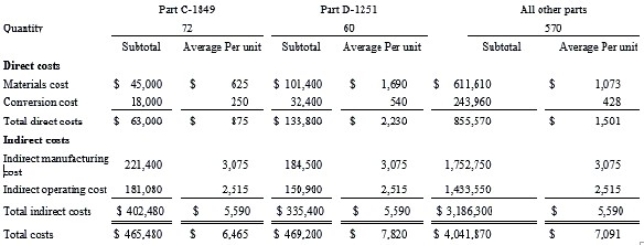

Consider the following cost and production information for Darrell Building Components, Inc.

Additional information:

∙ Sales revenue: $5,200,000.

∙ Beginning inventory: $275,000.

∙ The only spending increase was for materials cost due to increased production. All other spending as shown above was unchanged.

∙ Sales of all parts are the same as the number of units produced.

Darrell Building Components, Inc. uses the absorption costing method.

Required:

(a) Compute the (1) gross margin, (2) operating income, and (3) ending inventory for Darrell Building Components, Inc.

(b) Assume that production of part D-1251 increases by 25 units during the given period (sales remain constant). Re-compute the above amounts.

(c) Thane Smith, the cost manager of Darrell Building Components, argues with the controller that variable costing is a better method for product costing. Using the information in part (b) above, re-compute the operating income for Darrell Building Components using variable costing. Explain any differences in the operating incomes obtained under the two different methods.

Definitions:

Internal Controls

Processes designed to ensure the reliability of financial reporting, effective and efficient operations, and compliance with laws and regulations.

Savings and Loan Associations

Financial institutions specializing in accepting savings deposits and making mortgage and other loans.

Governments

Institutions that exercise authority and perform the functions of governing a political state, region, or community through the exercise of legislative, executive, and judicial powers.

Form 10-Q

A quarterly financial report that publicly traded companies must file with the SEC, detailing their financial performance.

Q10: The average selling price is $0.60 per

Q17: A restaurant is deciding whether it wants

Q30: Southside Hospital is trying to get a

Q38: In Kohlberg's Stage two of moral reasoning,

Q41: The Work-in-Process Inventory of the Model Fabricating

Q57: It is more important for financial accounting

Q86: Juran Company produces a single product.

Q99: Markham, Inc. has received a contract for

Q99: (CMA adapted) Cost drivers are:<br>A) activities that

Q146: <br>If Lamar produces and sells 30,000 units,