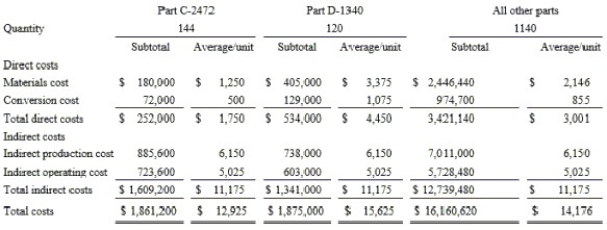

Consider the following cost and production information for Barnard Steel Building Company, Inc.

Additional information:

∙ Sales revenue: $20,000,000.

∙ Beginning inventory: $1,150,000.

∙ Sales of part D-1340: 80 units.

∙ Sales of all other parts are the same as the number of units produced.

∙ Sales price of part D-1340: $35,500 per unit

∙ The only spending increase was for materials cost due to increased production. All other spending as shown above was unchanged.

Barnard Steel Building Company uses the variable costing method.

Required:

(a) Compute the (1) contribution margin, (2) operating income, and (3) ending inventory for Barnard Steel Building Company.

(b) Assume that sales of part D-1340 increase by 30 units to 110 units during the given period (production remains constant). Re-compute the above amounts.

(c) Jaime Porter, the controller of Barnard Steel Building Company, is considering the use of absorption costing instead of variable costing to be in line with financial reporting requirements. She knows that the use of a different costing method will give rise to different incentives. Explain to her how alternative methods of calculating product costs create different incentives.

Definitions:

Q13: Which of the following is true about

Q19: J.C. Riley, who owns Riley's Auto Repair

Q25: CEO compensation is a function of the

Q40: You have been provided with the

Q49: Explain the distinction between predatory pricing and

Q82: Mobley Company makes three products in a

Q84: What is Lake's margin of safety in

Q89: All other things the same, which

Q103: The cost of fire insurance for a

Q127: The just-in-time (JIT) method of production focuses