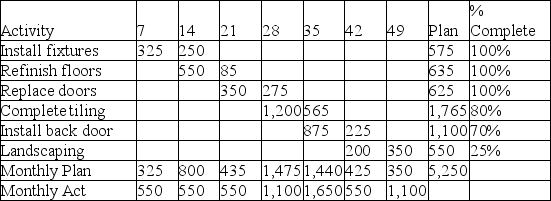

Use the earned value table for Project Makeready to calculate their schedule performance index.

Definitions:

WACC

Weighted Average Cost of Capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets.

Cost of Equity

Cost of equity is the return a company requires to decide if an investment meets capital return requirements and can be seen as the return on equity that shareholders expect for their investment risk.

Flotation Cost

The total costs incurred by a company in issuing new securities, including underwriting, legal, registration, and other expenses.

Cost of Capital

The rate of return a company must pay to its shareholders and debt holders, representing the cost of obtaining funds to finance its operations.

Q4: Termination by addition occurs when:<br>A) Scope creep

Q35: The one factor that earned value management

Q43: There's an old saying, "The job is

Q52: The final items that are left to

Q67: Surveys on the early warning signs of

Q69: Traditionally, the HRM department was primarily a(n)<br>A)

Q73: Use this earned schedule table to determine

Q77: One strength of S-curve analysis is that

Q94: How does employees' use of mobile devices

Q98: Consider the project that is neatly summarized