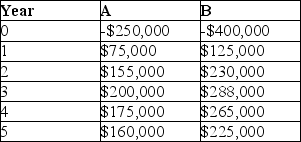

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%. Compute the payback in years and the net present value for both projects and offer advice as to the best course of action.

Definitions:

Q26: The Larson and Gobeli study that compared

Q29: A project with the chance for a

Q42: Nathan is teaching his son about dogs.

Q45: The firm set aside a little extra

Q54: A statement of work identifies:<br>A) A need.<br>B)

Q59: What are Block's six steps to stakeholder

Q65: A work package may consist of more

Q66: The classic triple constraint standard for project

Q85: Emotional intelligence is a more important measure

Q102: According to Melissa Hines and her colleagues