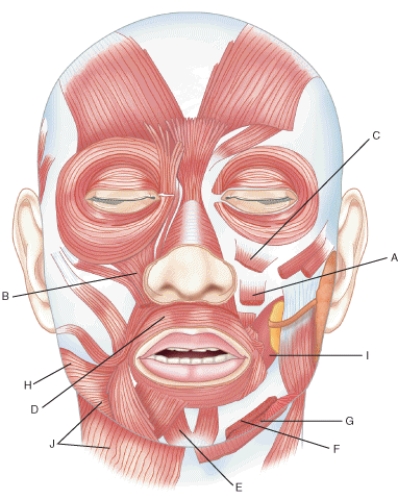

Match each labeled landmark or bone in the following figure to the correct descriptor. Terms may be used more than once or not at all.

-Risorius

Definitions:

FCFE Valuation Model

Free Cash Flow to Equity (FCFE) Valuation Model estimates the value of a company by calculating the present value of its expected future cash flows available to shareholders, after deducting operational expenses, taxes, and reinvestment needs.

Required Rate of Return on Equity

The minimum rate of return that investors expect to receive on their equity investment in a company, taking into account the risk associated with the investment.

EBIT

Earnings Before Interest and Taxes, a measure of a firm’s profit that includes all expenses except interest and income tax expenses.

FCFF

Free Cash Flow to the Firm, a measure of a company's financial flexibility that represents the amount of cash generated by a company that is available for distribution among all its security holders.

Q3: The _ process is the inferior-most aspect

Q13: Which term refers to the study of

Q21: Courses from the thoracolumbar fascia to the

Q29: Form of inspiration that requires use of

Q46: Mediated by the IX glossopharyngeal nerve<br>A)salty<br>B)sweet<br>C)umami<br>D)bitter

Q63: Angle

Q76: _ acts as a shock absorber and

Q101: _ tissue is specialized for communication.

Q104: Which of the following is defined as

Q111: The superior-most structure of the sternum<br>A)corpus sterni<br>B)manubrium