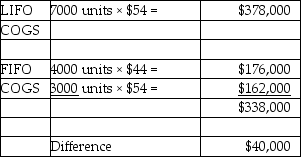

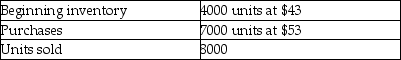

-Using the following data, by how much would taxable income change if FIFO is used rather than LIFO?

Definitions:

Marginal Rate Of Substitution

The rate at which a consumer can give up some amount of one good in exchange for another good while maintaining the same level of utility.

North American Free Trade Agreement

A trade agreement among the United States, Canada, and Mexico to reduce trade barriers and promote economic exchange.

Efficient Equilibrium

A state of balance in a market where resources are allocated in the most efficient way possible, with no room for welfare improvement without making someone else worse off.

Relative Price

The price of one good or service compared to another, usually indicating how much of one can be exchanged for the other.

Q9: An investment, which was purchased for $400,000

Q23: The principal amount of a note is

Q26: On August 1, 2016, Brian Quinn received

Q37: To document approval of purchase returns, management

Q66: When inventory costs are increasing, the FIFO

Q84: Thomas Industries reported the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7273/.jpg"

Q139: The two major types of receivables are

Q142: The gross profit percentage equals net sales

Q148: To determine the cost of goods sold,

Q181: Gains on the sale of equipment increase