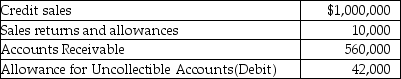

At the end of the year, Smith Company has the following information available:  The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense. In the prior year, uncollectible accounts were estimated at 1% of credit sales. What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense. In the prior year, uncollectible accounts were estimated at 1% of credit sales. What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

Definitions:

Variable Overhead Efficiency Variance

The difference between the actual level of activity (direct labor-hours, machine-hours, or some other base) and the standard activity allowed, multiplied by the variable part of the predetermined overhead rate.

Direct Labour Hours

The total hours worked by employees directly involved in producing goods or delivering services, used to allocate labor costs accurately.

Standard Hours Allowed

The time that should have been taken to complete the period’s output. It is computed by multiplying the actual number of units produced by the standard hours per unit.

Labour Rate Variance

The difference between the actual cost of labour per hour and the standard cost that was expected, multiplied by the total hours worked.

Q7: On January 4, 2017, Margaret's Cafe acquired

Q72: Why are adjusting entries prepared?<br>A)Because some accounts

Q99: Under the _ method, ending inventory is

Q107: List three ways in which the gross

Q115: An error in the ending inventory for

Q125: A conservative policy with regard to capitalizing

Q136: The inventory turnover ratio:<br>A)is determined by dividing

Q149: When applying the lower-of-cost-or-market rule to inventory

Q162: When applying the lower-of-cost-or-market rule to inventories,

Q199: When preparing the balance sheet, the final