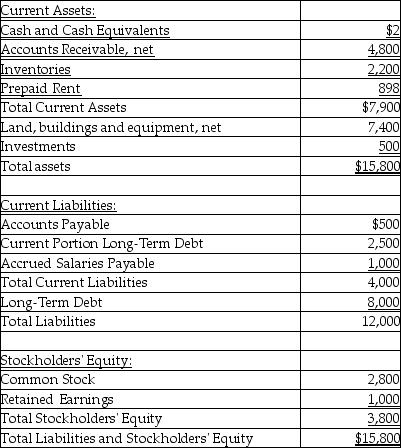

The balance sheet at December 31, 2017 for Zumba Company follows:

in thousands of dollars, unless otherwise specified

Additional information follows:

Additional information follows:

1. Net income for the year ended December 31, 2017 is $2,020.

2. Cost of goods sold for the year ended December 31, 2017 is $4,400.

3. Inventory on January 1, 2017 is $1,800.

4. Accounts Receivable, net on January 1, 2017 are $4,400.

5. Total assets on January 1, 2017 are $20,000.

6. Net credit sales for the year ended December 31, 2017 are $14,600.

7. Net income before interest and taxes for the year ended December 31, 2017 is $4,800.

8. Interest expense for the year ended December 31, 2017 is $550.

9. Total stockholders' equity on January 1, 2017 is $3,500.

Compute the following ratios:

1. Current ratio

2. Quick ratio

3. Accounts receivable turnover

4. Days' inventory outstanding

5. Times interest earned

6. Return on assets

7. Return on equity

Definitions:

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated by adding new purchases to beginning inventory and then subtracting goods sold.

Periodic Inventory System

An inventory system in which the inventory records are updated only after a physical count has been taken at periodic intervals, usually at the end of an accounting period.

Inventory Account

An account in the ledger that tracks the cost of goods a company has in stock that are available for sale.

Internal Control

Processes adopted by organizations to ensure accuracy and integrity in financial reporting, operational efficiency, and compliance with laws and regulations.

Q2: Comprehensive income includes net income plus:<br>A)Foreign-Currency Transaction

Q11: Mews Corporation has the following information reported

Q13: Financial analysis helps mainly to identify the

Q18: On December 31, Copper Corporation has the

Q22: On December 31, Mercury Corporation has the

Q27: The independent auditors' report is addressed to:<br>A)stockholders

Q29: Benchmarking common size variables against a key

Q91: The book value per share of common

Q112: The purpose of channel stuffing is to

Q177: To help keep debt ratios within normal