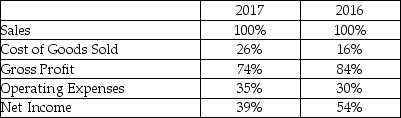

Reimer Company reports the following data:  When evaluating the results of operations, what can be said about Reimer Company?

When evaluating the results of operations, what can be said about Reimer Company?

Definitions:

Eye Injuries

A term referring to any harm or damage caused to the eye(s) due to accidents, exposure to chemicals, or physical trauma.

Fowler's Position

A semi-sitting position with the head and upper half of the body elevated, commonly used to promote respiratory function.

Fenestrated Drape

A surgical drape with one or more openings, designed to expose only the operative site, while maintaining a sterile field around it.

Sitting Position

A posture where the torso is upright and the buttocks rest on a surface like a chair, with legs typically bent at the knees.

Q3: Using the indirect method to calculate net

Q6: For the period from 2017 to 2018,

Q19: Economic value added (EVA®)can be computed as

Q24: Gia Company has the following information available:

Q53: When preparing a cash budget, a company

Q85: On December 31, Anway Corporation reports the

Q92: When a business purchases land with a

Q102: Why is the income statement prepared first

Q131: Regarding the retained earnings account, which of

Q186: The ledger:<br>A)is a grouping of all of