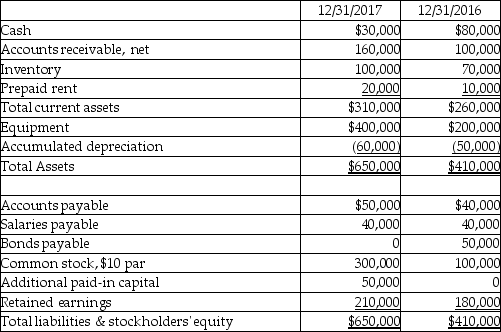

Matthauson Company has the following comparative balance sheet data available:

Additional information:

Additional information:

1. The company reports net income of $100,000 and depreciation expense of $20,000 for the year ending December 31, 2017.

2. Dividends declared and paid in 2017, $70,000.

3. Equipment with a cost of $20,000 and accumulated depreciation of $10,000 was sold for $3,000.

4. New equipment was purchased for cash.

5. No common stock was retired during 2017.

The company also reports the following income statement for the year ending December 31, 2017:

Using the direct method, prepare the statement of cash flows for the year ending December 31, 2017.

Using the direct method, prepare the statement of cash flows for the year ending December 31, 2017.

Definitions:

Expressed Anger

The outward display or expression of anger, which can include verbal outbursts, facial expressions, or physical actions.

Reactivity

The tendency of a substance to undergo a chemical reaction, either by itself or with other materials, or the extent to which individuals modify their behavior when they know they are being observed.

Rumination

The compulsive focused attention on the symptoms of one's distress, and on its possible causes and consequences, as opposed to its solutions.

Monounsaturated Fats

Fatty acids found in certain foods like olive oil and avocados that have one double bond in the fatty acid chain, considered healthier compared to saturated fats.

Q12: The formula for the percentage change in

Q16: The financial statements are the responsibility of:<br>A)the

Q23: Seidner Company had the following account balances

Q108: Where are stock dividends reported on the

Q114: Define accounting.

Q118: The debt created by a business when

Q123: On August 15, a customer paid $5000

Q133: Small stock dividends are recorded at market

Q142: Which financial statements cover a period of

Q169: When listing the accounts on the trial