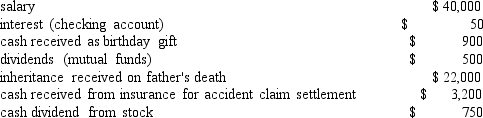

From the information given below,determine Marcie's gross income for tax purposes:

Definitions:

Anterograde Amnesia

A condition where a person is unable to form new memories following the onset of the disorder.

Personal Information

Data relating to an individual that can be used to identify, contact, or locate a single person.

Repressed Memories

Memories that have been unconsciously blocked due to being associated with a high level of stress or trauma.

Dissociative Amnesia

Loss of memory for important facts about a person’s own life and personal identity, usually including the awareness of this memory loss.

Q30: The amount of goods and services each

Q32: Investment assets include items such as boats

Q42: Sam and Lele are in their late

Q79: Your tax filing status [would | would

Q84: One could use statements from their various

Q133: [Medical expenses | Rent payments] would be

Q149: Janie Long has checking and savings accounts

Q171: Net worth is measured by<br>A) bank card

Q184: Balance sheet liabilities should be recorded at

Q186: Low interest rates that have persisted since