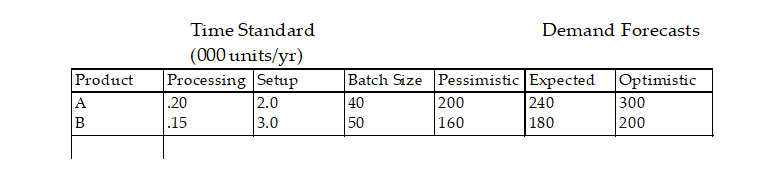

Table 5.2

High Tech, Inc. is producing two types of products: A and B. Both are produced at the same sawing operation. Because of demand uncertainties, the operations manager obtained three demand forecasts (pessimistic, expected, and optimistic) . The demand forecasts, batch sizes (units/batch) , processing times (hr/unit) , and setup times (hr/batch) follow.

The sawing machines operate on two 8- hour shifts, 5 days per week, and 50 weeks per year. The manager wants to maintain a 10 percent capacity cushion.

-Using the information from Table 5.2, if the operation currently has 18 machines and the manager is willing to expand capacity by 20 percent through short- term options, what is the capacity gap (in terms of number of machines) if you assume the optimistic demand forecasts?

Definitions:

Expected ROE

The projected return on equity for a future period, based on estimates of future earnings and shareholders' equity.

Risk-free Rate

An anticipated earning on an investment that is free from the danger of monetary loss, commonly illustrated by the return rate on state-issued securities.

Market-capitalization Rate

The combined value of all a company's shares currently on the market, found by taking the current price of one stock and multiplying it by the total number of shares available.

Expected Return

The anticipated average return of an investment over a specified period, based on historical data or statistical analysis.

Q19: A _ seeks to find the most

Q24: A job shop process has a relatively

Q31: The International Standard ISO 26000:2010 produced a

Q40: As the setup cost (S) increases, the

Q44: If a system is well balanced, which

Q75: When should complete inspection be used?<br>A) when

Q94: More vertical integration means more outsourcing.

Q103: _ refers to the mixing of the

Q112: List the JIT scheduling tactics.

Q180: Appraisal costs are associated with preventing defects