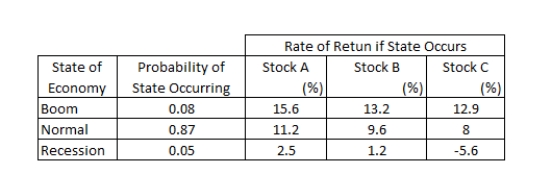

Given the following information, what is the expected return on a portfolio that is invested 30 percent in both Stocks A and C, and 40 percent in Stock B?

Definitions:

Break-even Point

The level of sales at which total revenues equal total costs, resulting in no net profit or loss.

Sales Mix

Sales mix refers to the combination of different products or services that a company sells, impacting the overall profitability depending on the profit margin of each product or service.

Variable Expenses

Expenses that fluctuate with the level of output or activity, in contrast to fixed expenses that remain constant regardless of activity level.

Net Operating Income

The earnings a business retains after subtracting operational costs, prior to the deduction of interest and taxes.

Q1: Soft and Cuddly is considering a new

Q12: The Flour Baker is considering a project

Q13: Overboard Excursions just announced it will be

Q20: Roller Coaster's has a WACC of 11.6

Q20: Of the following, which two are the

Q28: Which one of the following is the

Q45: Which one of the following statements concerning

Q54: Blue Bell stock is expected to return

Q61: Which one of the following is minimized

Q75: What is the payback period for a