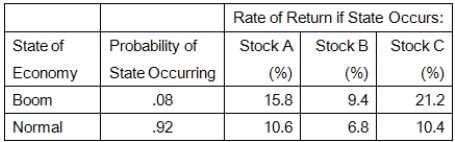

Given the following information, what is the variance of the returns on a portfolio that is invested 40 percent in both Stocks A and B, and 20 percent in Stock C?

Definitions:

Current Ratio

A financial metric that measures a company's ability to pay its short-term obligations with its short-term assets, calculated by dividing current assets by current liabilities.

Debt-to-Equity

A measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity, indicating the relative proportion of shareholder equity and debt used to finance the company's assets.

Total Asset Turnover

A financial ratio that measures a company's efficiency in using its assets to generate sales or revenue.

Earnings Per Share

A measure of a company's profitability, calculated by dividing its net income by the number of outstanding shares.

Q1: Kate could not attend the last shareholders'

Q4: A bond has an average return of

Q12: Sweet Treats pays a constant annual dividend

Q21: The net present value of an investment

Q35: River City Recycling just paid its annual

Q39: Gabe's Market is comparing two different capital

Q69: Services United is considering a new project

Q70: An investment has an initial cost of

Q83: Kline Construction is an all-equity firm that

Q97: All else constant, an increase in a