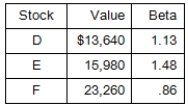

Currently, you own a portfolio comprised of the following three securities.How much of the riskiest security should you sell and replace with risk-free securities if you want your portfolio beta to equal 90 percent of the market beta?

Definitions:

Government Expenditures

The total amount of money spent by the government in a given period, including spending on goods and services, transfer payments, and interest on debt.

Federal Reserve

The central banking system of the United States, responsible for conducting the nation's monetary policy and regulating its financial institutions.

Treasury

The government department responsible for developing and executing the national fiscal policy, including the collection of revenue and expenditure of government funds.

National Debt

The total amount of money that a country's government has borrowed, typically as a result of deficit spending.

Q13: Which type of stock pays a fixed

Q23: Scenario analysis is best described as the

Q25: Which statement is correct?<br>A)A portfolio that contains

Q41: The Piano Movers can borrow at 7.8

Q45: The static theory of capital structure assumes

Q45: Which one of the following statements concerning

Q54: Which one of the following is an

Q68: Stock prices tend to _ following the

Q71: Which statement is correct?<br>A)Cash dividends and stock

Q99: Over the past four years, a stock