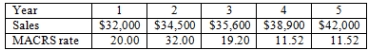

The Blue Lagoon is considering a project with a five-year life.The project requires $32,000 of fixed assets that are classified as five-year property for MACRS.Variable costs equal 67 percent of sales, fixed costs are $12,600, and the tax rate is 34 percent.What is the operating cash flow for Year 4 given the following sales estimates and MACRS depreciation allowance percentages?

Definitions:

Experimental Control

The practice of eliminating or managing variables that can affect the outcome of an experiment, except for the variable being studied.

Causal Relationships

Refers to the connection between two variables where a change in one variable directly causes a change in the other variable.

Internal Validity

The extent to which a study can rule out or make unlikely alternate explanations of the results, thereby attributing the results directly to the effect of the independent variable.

National Science Foundation

A United States government agency that supports fundamental research and education in all non-medical fields of science and engineering.

Q1: Which one of the following is the

Q16: T.L.C.Enterprises just revised its capital structure from

Q19: Ready To Go is an all-equity firm

Q24: You purchased a zero coupon bond one

Q29: A bond's indenture agreement generally includes all

Q75: Gulf Coast Tours currently has a weighted

Q76: You would like to create a portfolio

Q86: In the process of liquidation, some types

Q91: A 15-year, annual coupon bond is priced

Q123: A bond has a $1,000 face value,