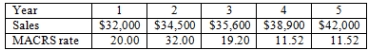

The Blue Lagoon is considering a project with a five-year life.The project requires $32,000 of fixed assets that are classified as five-year property for MACRS.Variable costs equal 67 percent of sales, fixed costs are $12,600, and the tax rate is 34 percent.What is the operating cash flow for Year 4 given the following sales estimates and MACRS depreciation allowance percentages?

Definitions:

Present Value Methods

A set of financial techniques used to calculate the current worth of a future stream of earnings or cash flows, taking into account the time value of money.

Time Value of Money

The concept that money available now is worth more than the same amount in the future due to its potential earning capacity.

Net Present Value Method

A financial analysis technique used to assess the profitability of an investment by calculating the difference between the present value of cash inflows and outflows.

Future Cash Inflows

Expected cash receipts or revenues generated from business activities in future periods.

Q10: Vegan Delite stock is valued at $68.60

Q14: Over the past five years, a stock

Q27: Ignoring the option to wait:<br>A)may overestimate the

Q27: Which one of the following is the

Q47: Which one of the following terms applies

Q48: You are comparing two possible capital structures

Q48: The 7 percent preferred stock of Midwest

Q62: You are given the following information concerning

Q72: You are analyzing a project and have

Q84: You bought a share of 7.5 percent