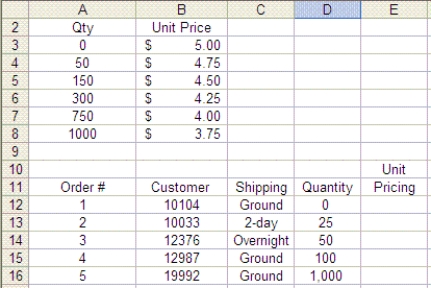

Mark is in charge of determining the unit pricing for each order for robot toys. Please refer to the chart above as you answer the questions below.

-Mark writes a formula to look up the unit pricing for each order. He starts by writing one for Order #1 and then plans to copy it from E12 to E13:E16. The correct formula would be ____.

Definitions:

Semi-Annually

Occurring or carried out twice a year, typically used in the context of payments, interest accrual, or reporting periods.

Yield-To-Maturity

The total return anticipated on a bond if it is held until the maturity date.

Bond Principle

The face value of a bond, which is the amount to be repaid by the issuer to the bondholder at maturity.

Bankruptcy

A legal process wherein individuals or entities declare their inability to pay back their debts.

Q6: You can use relational operators and _

Q6: #10<br>A)Data series<br>B)Chart title<br>C)Data table<br>D)X-axis labels<br>E)X-axis<br>F)Legend<br>G)Y-axis<br>H)Y-axis labels<br>I)Gridlines<br>J)Data point

Q12: You can use the ISEMPTY function to

Q15: Equal to<br>A)=3+5=8<br>B)=100>MAX(5,10,20)<br>C)=B3<C3 where cell B3=5 and cell

Q20: INDEX<br>A)#1<br>B)#2<br>C)#3<br>D)#4<br>E)#5

Q34: VALUES area<br>A)#1<br>B)#2<br>C)#3<br>D)#4<br>E)#5<br>F)#6<br>G)#7

Q106: A(n) _ function is a Boolean logical

Q113: Cells that contain formulas should be specified

Q116: When you have many input assumptions that

Q144: To control the display of individual labels