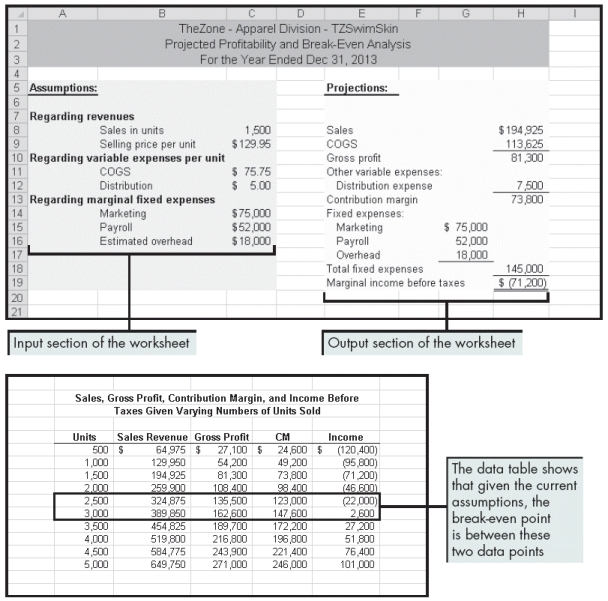

Beckham created the worksheets above to show the profitability and break-even points for his company. Please refer to the figure above as you answer the questions below.

-Beckham has received word from the Purchasing Department that there could be some variance in the COGS. He wants to develop a worksheet that shows the effects of various interactions between the selling price and the cost of goods sold per unit on profitability. In the two-variable data table, how would he set it up?

Definitions:

Package

A namespace that organizes classes and interfaces by functionality or modules, often used to ensure code modularity and reusable software components.

Java.util

A package in the Java programming language that contains collections of utility classes, including data structures, date and time facilities, and random number generators.

Vector

In programming, a dynamic array that can grow or shrink in size as needed. In mathematics, it represents a quantity having both magnitude and direction.

Empty Vector

A vector data structure that contains no elements and has a size of zero.

Q20: In the Solver answer report, when the

Q31: Knowledge was spread throughout Europe by the

Q37: In the IRR function, the guess argument

Q39: In the FIND function _ is the

Q44: The TRIM function removes all spaces in

Q51: Yucatán Peninsula

Q81: The traditions of Aztec human sacrifice and

Q94: The formula auditing tool called _ toggles

Q95: Data table cells containing values that can

Q119: Cash amounts that are either received or