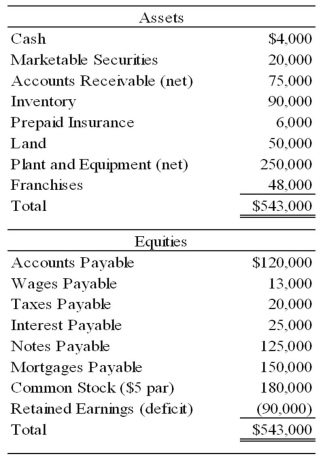

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code. The balance sheet on December 31, 20X8, is as follows:

The following additional information is available:

1. Marketable securities consist of 2,000 shares of Bristol Inc. common stock. The market value per share of the stock is $8. The stock was pledged against a $20,000, 8 percent note payable that has accrued interest of $800.

2. Accounts receivable of $40,000 are collateral for a $35,000, 10 percent note payable that has accrued interest of $3,500.

3. Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000. The appraised value of the remainder of the inventory is $50,000.

4. Only $1,000 will be recovered from prepaid insurance.

5. Land is appraised at $65,000 and plant and equipment at $160,000.

6. It is estimated that the franchises can be sold for $15,000.

7. All the wages payable qualify for priority.

8. The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000. The accrued interest on the mortgages is $7,500.

9. Estimated legal and accounting fees for the liquidation are $10,000.

Required

a. Prepare a statement of affairs as of December 31, 20X8.

b. Compute the estimated percentage settlement to unsecured creditors.

Definitions:

Honeymoon Phase

A period of initial euphoria and idealization in a relationship or marriage, where conflicts are minimal, and romantic feelings are heightened.

Reconciliation Phase

The stage in the conflict resolution or relationship recovery process where parties involved come to an agreement, resolve differences, and make efforts to restore positive relations.

Battered-woman Syndrome

A psychological condition that can result from prolonged domestic violence, leading to feelings of helplessness and severe stress.

Domestic Violence

Acts of violence or aggression by one person against another within the domestic setting, including physical, emotional, or sexual abuse.

Q3: What is the dependent variable?<br>A) Type of

Q4: Ordered: Magnesium sulfate 1 g per hr

Q5: Which mixed methods design is best represented

Q9: If a researcher reports the most common

Q14: Which of the following documents would you

Q15: Ordered: 40 units Humulin R insulin in

Q23: Regulation S-X and Regulation S-K:<br>A) govern the

Q30: Ordered: Heparin 1200 units per hour<br>Available: 1000

Q65: In a statement of revenues, expenditures, and

Q69: Revenue and expense on a government-wide statement