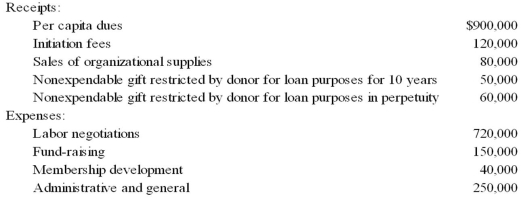

Golden Path, a labor union, had the following receipts and expenses for the year ended December 31, 20X8:  The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

Based on the information provided, in Golden Path's statement of activities for the year ended December 31, 20X8, what amounts should be reported under the classifications of temporarily and permanently restricted net assets?

Definitions:

Bond Indenture

A legal document specifying the terms and conditions under which a bond has been issued, including the interest rate, maturity date, and covenants.

Fiscal Year

A one-year period used for financial reporting and budgeting that does not necessarily coincide with the calendar year, varying between organizations.

Times Interest Earned

A ratio measuring a company's ability to meet its interest payments based on its operating income, indicating financial health and creditworthiness.

Tax Rate

The percentage at which an individual or corporation is taxed.

Q3: In what section would you find a

Q3: Enterprise and internal service funds should recognize

Q7: In the ABC partnership (to which Daniel

Q9: Toledo Imports, a calendar-year corporation, had the

Q11: Which of the following design types would

Q14: ASC 270 uses which view of interim

Q17: Missoula Corporation disposed of one of its

Q26: Ordered: 68 units <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1818/.jpg" alt="Ordered: 68

Q43: Each of the following questions names an

Q58: Upon completion of construction and full payment