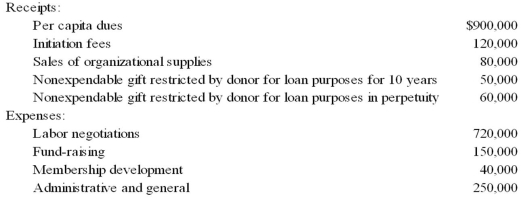

Golden Path, a labor union, had the following receipts and expenses for the year ended December 31, 20X8:  The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

Based on the information provided, in Golden Path's statement of activities for the year ended December 31, 20X8, what amounts should be reported under the classifications of temporarily and permanently restricted net assets?

Definitions:

Spouse

A legally wedded husband or wife.

Gross Profit Percentage

A financial metric used to assess a company's financial health by showing the proportion of money left over from revenues after accounting for the cost of goods sold, expressed as a percentage.

Selling Expenses

Selling expenses are costs associated with the marketing and sale of products or services, including advertising, sales commissions, and the employment of sales personnel.

Excludes Gain

A term referring to certain types of profit that are not subject to tax under specific circumstances.

Q1: Order:10 mg per kg<br>Weight or body surface

Q4: Main Manufacturing Corporation reported consolidated revenues of

Q12: Which monthly report shows the results of

Q13: Ordered: Heparin 1500 units per hour<br>Available: 500

Q13: Which of the following statements makes clear

Q35: Which of the following acts requires that

Q38: The balance in Newsprint Corp.'s foreign exchange

Q78: The Town of Baker reported the following

Q86: Local Services, a voluntary health and welfare

Q100: A private, not-for-profit hospital expended $35,000 of