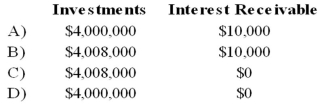

The City of Warwick received $4,000,000 from one of its most prominent citizens during the year ended June 30, 20X9. The donor stipulated that the $4,000,000 be invested permanently, and that interest and dividends earned on the investments be used to support the homeless people of Warwick. During the year ended June 30, 20X9, dividends received from stock investments amounted to $20,000, while interest received from bond investments amounted to $40,000. At June 30, 20X9, $10,000 of interest was earned, but it will not be received until July of 20X9. The fair value of the securities in which the $4,000,000 was invested had increased $8,000 by June 30, 20X9.

Refer to the above information. On the statement of fiduciary net assets at June 30, 20X9, the nonexpendable trust fund should report investments and interest receivable of:

Definitions:

Long-lived Assets

Assets expected to provide economic benefits over a period longer than one year, such as buildings, machinery, and equipment.

Capitalizes Expenditures

The process of recording a cost as an asset, rather than an expense, to be written off over the future period.

Rate-of-Return Comparisons

A method of evaluating the profitability of different investments by comparing their rates of return.

Operating Cycles

The period of time it takes for a business to purchase or create inventory, sell the products, and collect cash from the sales.

Q4: Analyze the data using open, axial, and

Q4: On January 2, 20X8, Johnson Company acquired

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q13: Which of the following would provide you

Q15: New research on coping skills should also

Q23: Trevor Company discloses supplementary operating segment information

Q29: Note: This is a Kaplan CPA Review

Q39: Which of the following presents the results

Q53: On January 1, 2008, Pace Company acquired

Q78: A budgetary comparison schedule presented as required